With the construction worker benefits that make the job more appealing Avail Rental Property Accounting tool, rental property bookkeeping is automated. This information can then be exported into a spreadsheet to further customize or share with tax professionals. Setting up a bank account for each rental property can help to avoid commingling, such as mixing personal and business funds or using a tenant security deposit to pay for property operating expenses. A good rental property accounting system also allows an investor to create individual accounts for each rental property that is owned so that income and expenses are credited and debited to the right property. Real estate investors can deduct a range of expenses to reduce their tax liability.

Tenant Reconciliation

Users on how to calculate straight line depreciation the P10, P20, and P30 pricing plans can purchase additional features, such as bank account management, tenant and owner portals, late fee automation, and exporting to QuickBooks and Excel for an extra $10/month. However, landlords who require comprehensive tenant management features beyond accounting capabilities may find REI Hub lacking compared to more all-in-one property management solutions. AppFolio is property management software that caters primarily to professional property managers with residential, commercial, and student housing properties. Keeping a shoebox full of receipts is no longer necessary or practical for busy rental property owners who want to run an effective business. Jeff has over 25 years of experience in all segments of the real estate industry including investing, brokerage, residential, commercial, and property management.

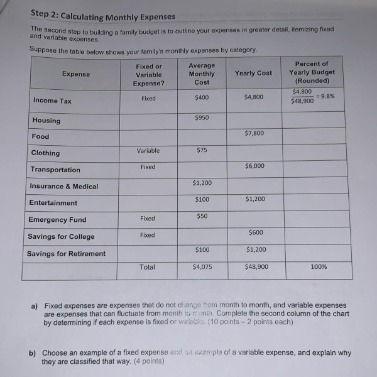

It is important to note that depreciation expense replaces deductions for payment on the cost of the property. Generally, your monthly mortgage payments will include payments of principal (paying back the cost of the property), interest, taxes, and insurance. The cost of principal cannot be deducted in a year along with the rest but is replaced by depreciation expense.

- This timeline also applies to most fixtures on your home, including a new roof or addition.

- It details the differences between rent control and rent stabilization, discusses pros and cons, and provides insights for landlords navigating this complex regulatory landscape.

- Journal entries are the individual financial transactions that are recorded in the general ledger.

- Having separate bank accounts keeps a landlord’s personal funds separate from business funds.

Cash Flow Statement Report

Taxes can easily overwhelm a real estate investor, especially in the early years of your investment. A CPA can assist with your rental accounting through bookkeeping services, consultation and tax preparation. The accrual basis method of accounting is more complex, but also considered the more accurate way to report revenue and expenses. In the example above, you would recognize 6 months of rent in the current tax year and wait to report the other half until the following year, when it was earned through providing the property to the tenant to rent. Investors who begin practicing good rental property accounting with their very first property will find it easier to scale up and grow a real estate investment portfolio. There are several critical components to rental property accounting, and banking is certainly one.

Consider Having Separate Accounts for Each Property

You can save time, keep all your transactions organized, and get useful insights into how your rental business is performing. If you own a rental property, you have to report all of the rental income you receive. For example, any expenses your tenants pay to you such as utilities, laundry revenue, late fees, and other fees, also count as rental income. Understanding the basics of how rental property accounting works is important, even when you use an online financial reporting system to sync income and expenses.

Instead, you want a comprehensive, intuitive, and powerful software platform that’s purpose-built for the unique challenges and opportunities that come with managing rental properties. There is a concept in accounting called an “accounting method.” This refers to a set of rules under which a business – or landlord, for that matter –reports its financials. Nobody loves filing their taxes, especially when you need to account for rental properties. However, it’s a familiar pain for many, as there are over 11 million independent landlords across the US.

It handles general business accounting needs, from invoicing and expense tracking to tax preparation and financial reporting. Quickbooks is incredibly flexible and powerful, which can sometimes make things more complicated than they need to be, especially when it comes to rental property finances. While accounting can be done on a simple spreadsheet, using a free rental property finance system like Stessa helps investors to easily keep track of property performance and generate a paper trail all in one place. Having separate bank accounts keeps a landlord’s personal funds separate from business funds.

Free Property Management Software That’ll Make Life Easier

First, establish good accounting hygiene when it comes to your rental property record-keeping, then use accounting software to help automate most of your finances. Next, your banking needs to be built out to optimize for the above real estate accounting best practices. Having a bookkeeping process in place removes having to total up all your expenses at the end of the year or when it’s time to complete your tax forms. Instead of sorting through multiple bank statements or rent roll reports, you can have your income and expenses already outlined to share with tax professionals or to analyze how your rentals are performing financially. While it may be tempting to have all your rental income deposited into your personal banking account, it’s important to create a separate bank account for your rental properties.

Its unique positioning as “asset management” software sets it apart from traditional property management platforms. Real estate investors use rental property accounting to track property financial performance at the 16 steps to starting a business while working full time property and portfolio level. The cash method of accounting reports income at the time it is received and bills at the time they are paid. For example, if you deposit $2,000 in rent on June 1st and pay $1,500 in bills in the month of June, using cash accounting you have a profit of $500 for the month of June. Many can agree that rental property accounting makes managing a rental stressful, especially if it’s your first time.