Depending on the services you offer, there may be times you have to meet with clients in person. However, these meetings more than likely make up a small portion of the work you do for your clients. Some accounting franchises specialize in one category while others may offer a suite of services. As we’ve seen, there are many great accounting franchises you can choose from when starting your own business.

- One of the franchise opportunities is to open a new retail office located in a specific franchise area.

- This involves setting up procedures to monitor financial transactions, including authorization, segregation of duties, and regular audits.

- By becoming a franchisee with Liquid Capital, you’ll be able to start a business in the growing alternative financing industry.

Benefits of Starting an Accounting Franchise

It helps to track the franchise’s financial performance and is important when seeking additional funding for the business. A cash flow statement shows the amount of cash entering and leaving a business over a specific period. It helps to track the franchise’s ability to what you need to know about tax season 2020 generate cash flow and maintain operational efficiency. Accurate cash flow records are vital for managing a franchise’s working capital requirements and ensuring cash is available when needed. Inventory management is the process of tracking and managing inventory levels. This is important for a franchise business, as excess inventory can tie up cash flow, while insufficient inventory can lead to lost sales.

This involves setting up procedures to monitor financial transactions, including authorization, segregation of duties, and regular audits. Effective internal controls will help minimize the risk of financial loss and provide assurance to franchise owners and stakeholders. A multi-unit franchise involves operating multiple franchise units within a specific territory. In this model, the franchisor generally provides more support and assistance with accounting procedures, but the franchisee still retains a significant degree of control.

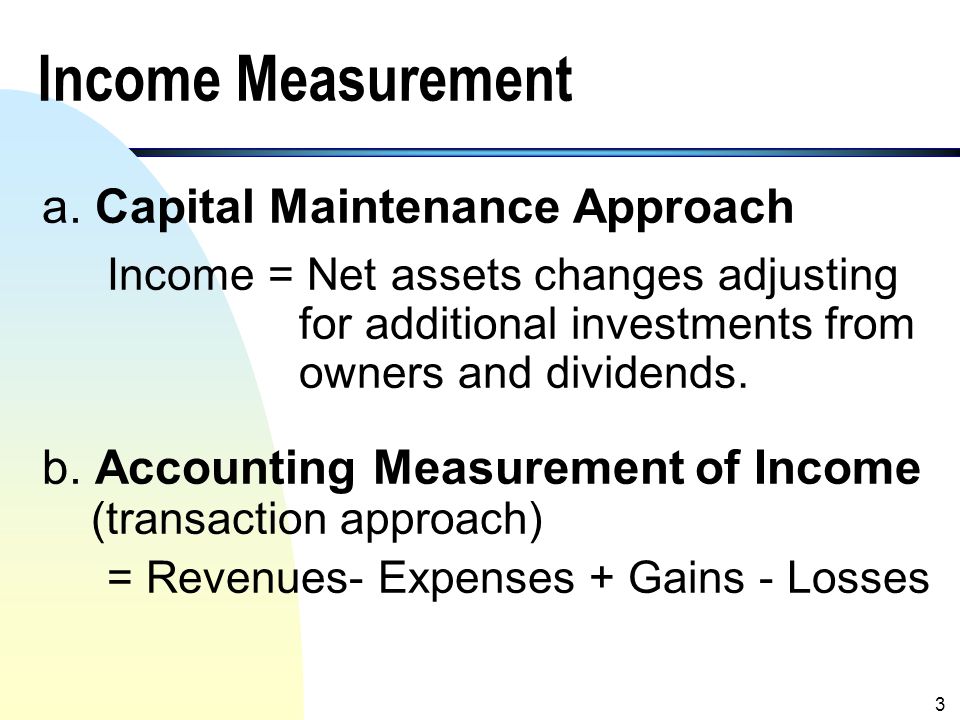

Initial fees

The franchisor is responsible for coordinating financial statements from all the franchise units, while the franchisee manages the day-to-day accounting process of each unit. Financial reporting is the process of preparing and presenting financial information to stakeholders. This includes the income statement, balance sheet, and cash flow statement. Financial what is a prepaid insurance expense reporting is important for the franchise owner, as it provides a snapshot of the financial health of the business. Franchise accounting is essential for the success of the franchise business. It provides accurate financial information that helps the franchise owner make informed decisions about the business.

Padgett Business Services

By starting a Succentrix Business Advisors franchise, you’ll be able to serve clients by helping them improve business efficiency, profitability, and overall success. Liberty Tax offers access to top-notch tax prep and filing software, back-office support, and many useful marketing assets to bring in a steady stream of clients. The IRS estimates that it takes 16 hours (including the time it takes to gather the necessary documents) to complete the Form 1040, the individual return that nearly 70% of Americans use. There are a number of accounting franchises available, some of which you may have heard of and some you likely haven’t. The decision to start an accounting business on your own or with the support of a franchise system depends on what kind of operation and lifestyle you want to have.

One thing for certain is that businesses will always need help preparing and filing their taxes. By becoming a franchisee with Liberty Tax, you’ll be able to enter this lucrative field while leveraging its 25 years of experience in tax-related services. Additionally, the franchise you choose will provide you with all the necessary resources, training, and support you need to begin your journey of business ownership. Over the past 4 years, we have doubled the number of Paramount Tax and Accounting franchise locations across the United States. Our franchisees’ unmatched success has been paramount to our expansive growth. Please keep scrolling to learn more about the benefits of franchising with us.

This model is suitable for those who want more control how to file your own taxes over their business finances. Managing the finances of a multi-unit franchise can be more complex than a single-unit franchise, as the franchisee has to handle multiple accounting processes simultaneously. However, this model provides economies of scale, allowing the franchisee to benefit from bulk purchasing, shared marketing, and centralized accounting services. The franchisee can also leverage the franchisor’s expertise in accounting and financial management to improve their business operations. Within the accounting franchise sector, one of the fastest-growing services is cost reduction consulting. A vast majority of accounting franchises offer franchisees the opportunity to run their business online — i.e. from a home office or other remote location.

In franchise accounting, the franchisee owns an individual franchise location. Buying a franchise can help you grow your business faster because of the recognizable brand. A balance sheet is a financial statement that shows a company’s assets, liabilities, and equity at a particular time. It provides insights on a franchise business’s financial position and helps to track changes in assets and liabilities over time. It’s essential to maintain accurate balance sheet records to evaluate the franchise’s financial health.